Table of Contents

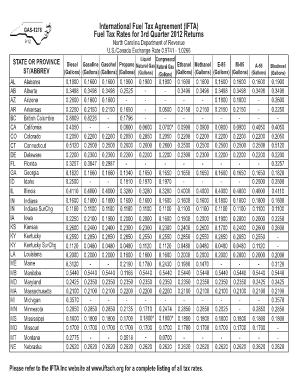

- Ifta Fuel Tax Rates 4th Quarter 2024 - Danya Ellette

- Fillable Online tax ny IFTA, Inc. International Fuel Tax ...

- IFTA Tax Requirements And IFTA Bond Requirements

- 2025 Federal Tax Tables | Real Business Solution Blog

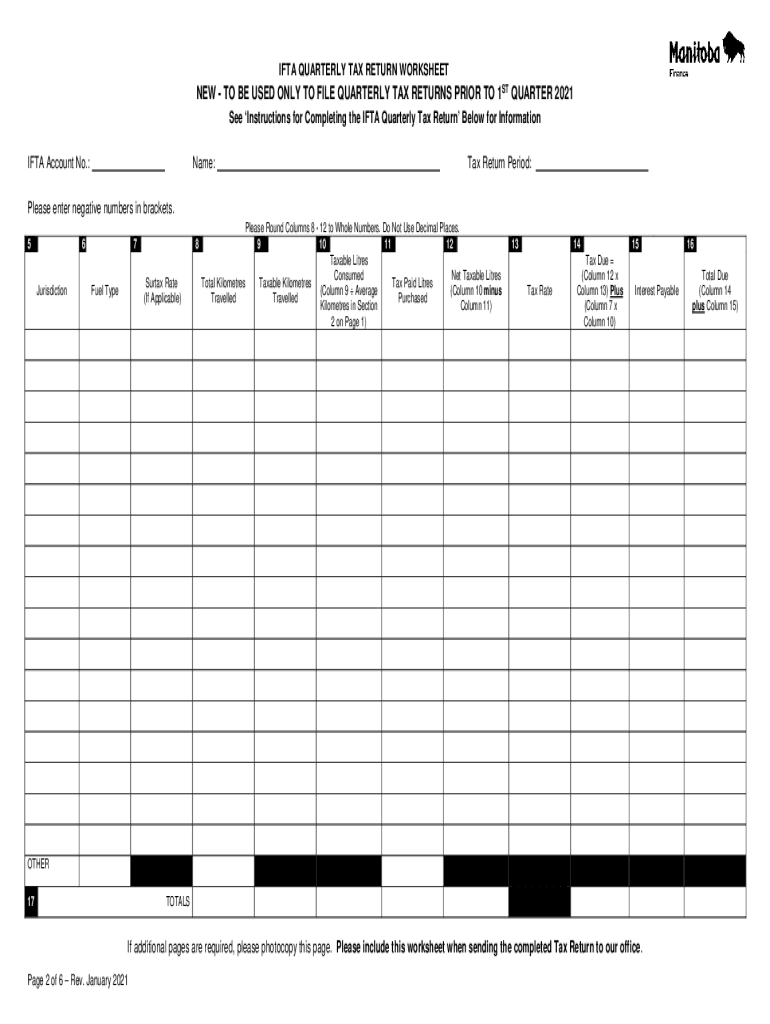

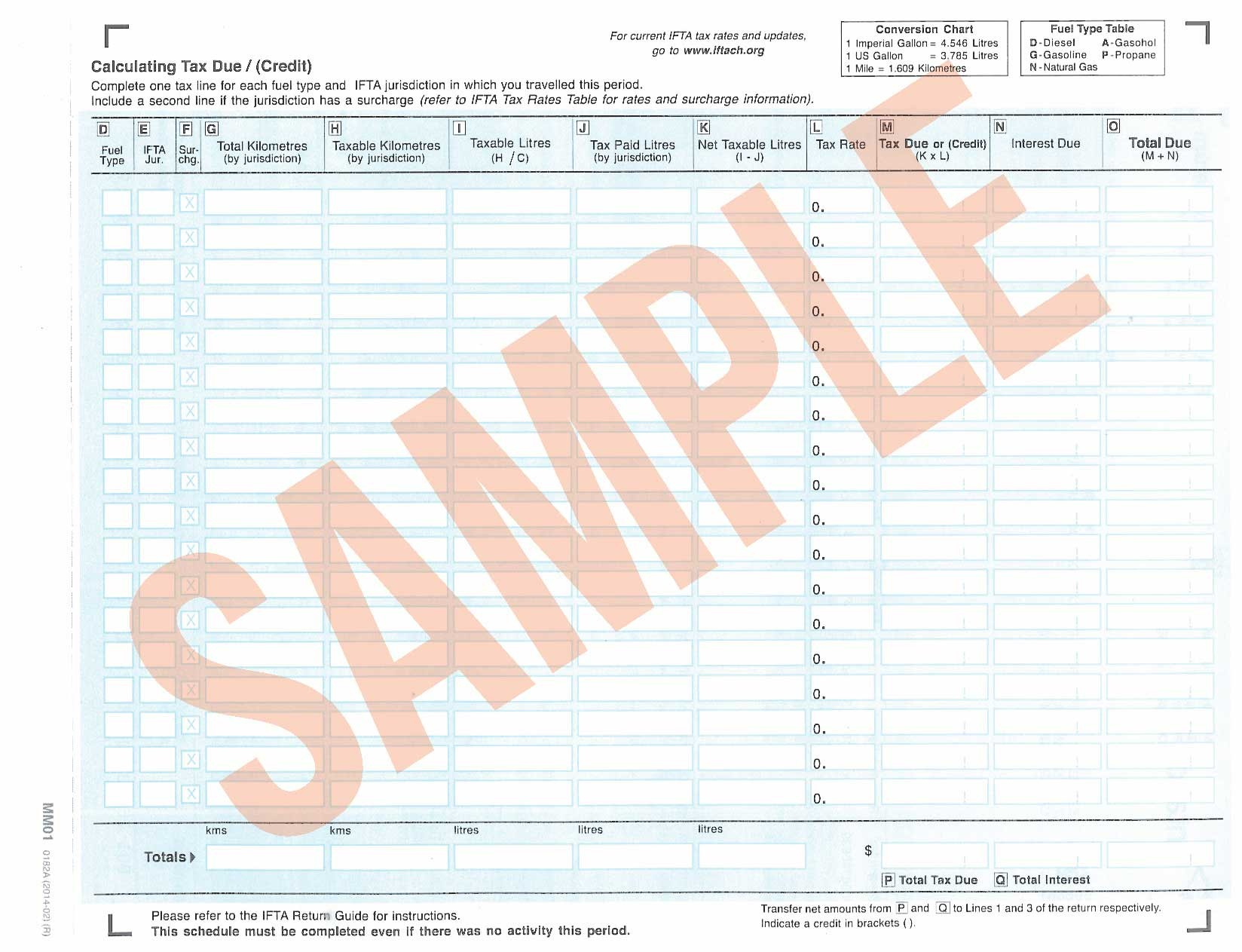

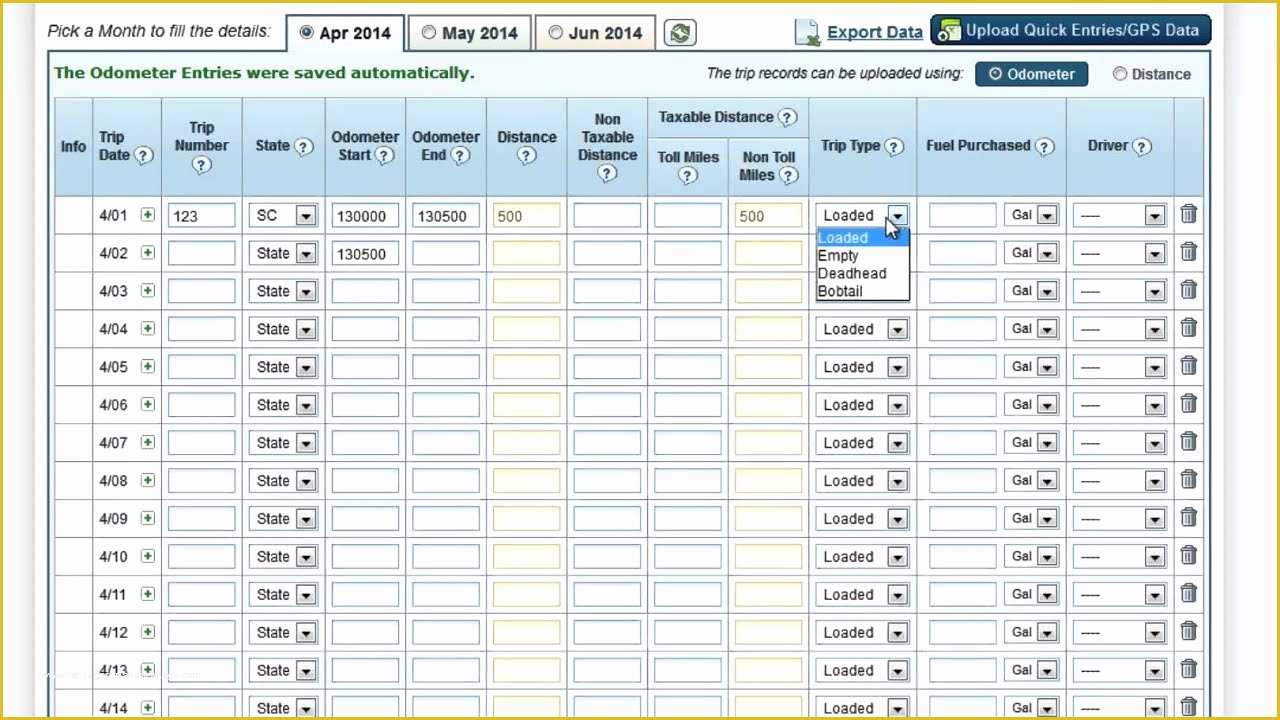

- Ifta Reporting 2021-2025 Form - Fill Out and Sign Printable PDF ...

- Printable Ifta Forms

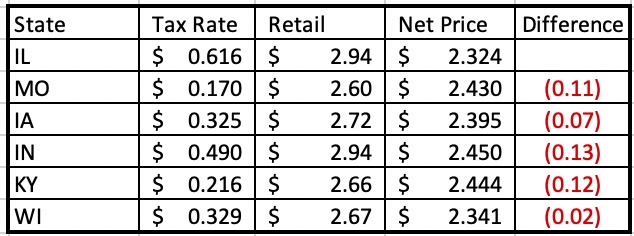

- Understanding IFTA and Fuel Taxes | Episode 29 | Haulin Assets

- Ifta Quarterly Fuel Tax Schedule 2024 - Gail Paulie

- 3rd Quarter IFTA Tax Rate Changes for 2023! | by TruckLogics | Medium

- Ifta Quarters 2022-2025 Form - Fill Out and Sign Printable PDF Template ...

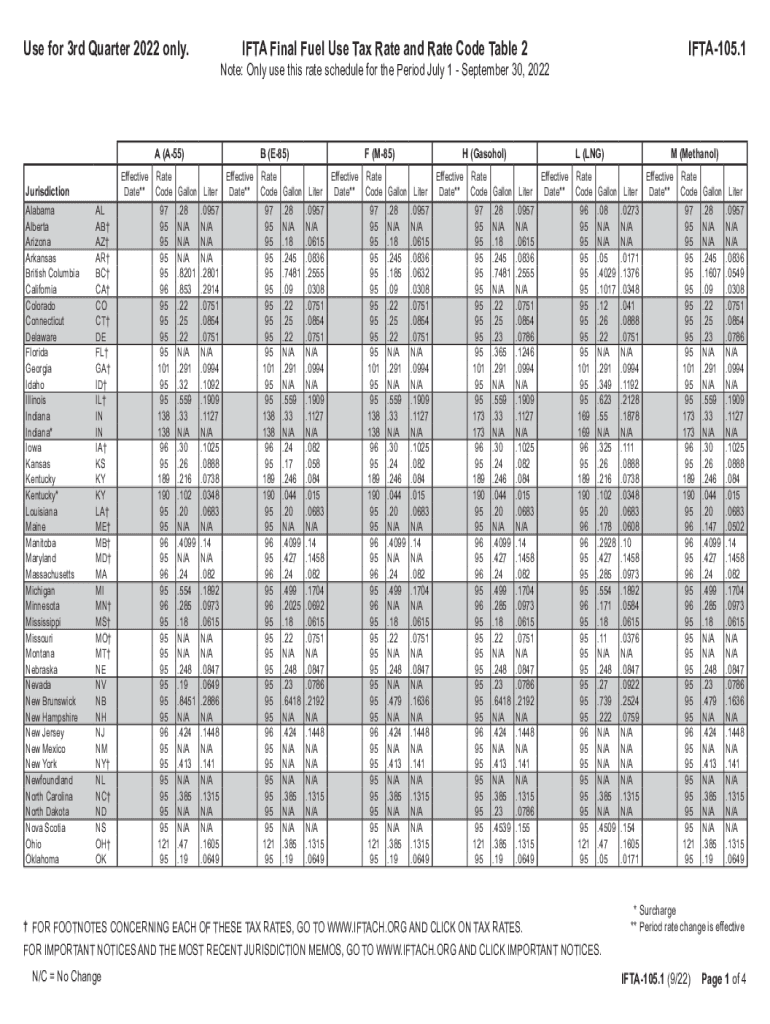

What is IFTA-105?

Importance of Final Fuel Use Tax Rate and Rate Code Table 1

How to Use the IFTA-105 Form and Table 1

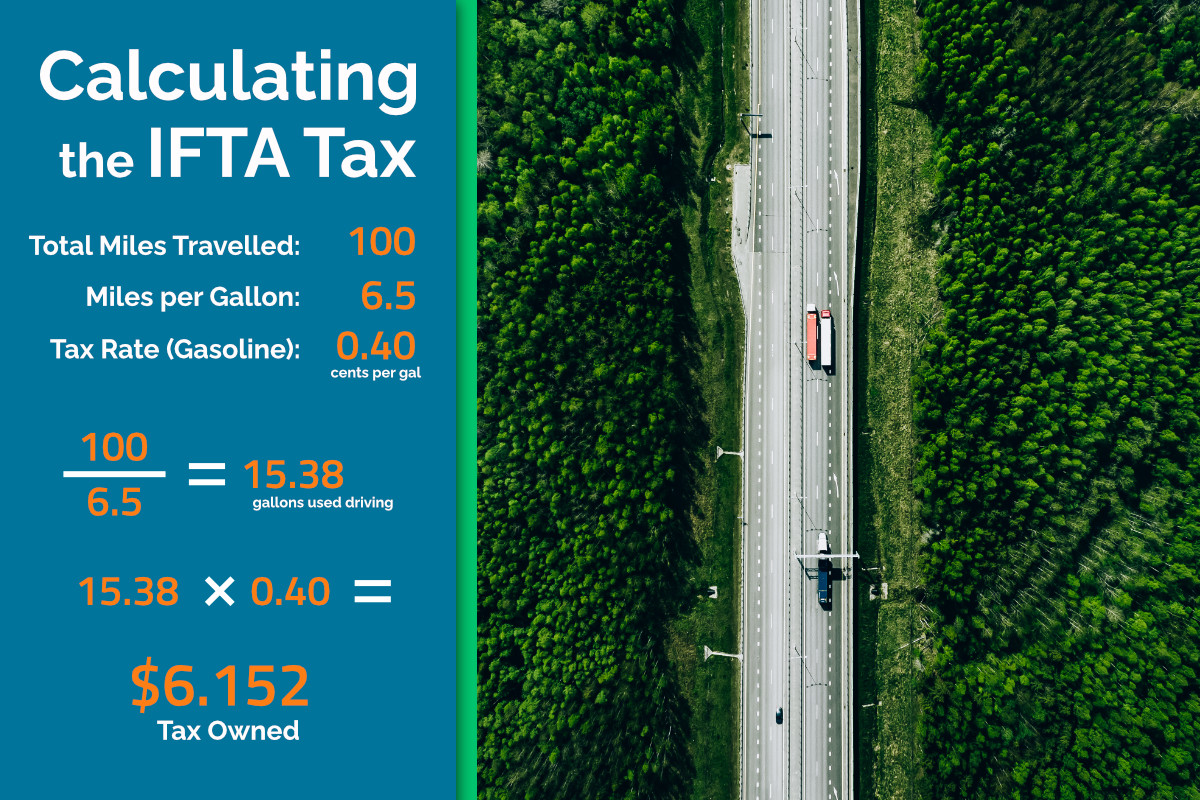

To accurately complete the IFTA-105 form and utilize Table 1, carriers should follow these steps: 1. Determine Jurisdictions: Identify all jurisdictions (states or provinces) where fuel was consumed. 2. Gather Fuel and Distance Records: Collect detailed records of fuel purchased and distance traveled in each jurisdiction. 3. Reference Table 1: Use the Final Fuel Use Tax Rate and Rate Code Table 1 to find the applicable tax rate for each jurisdiction. 4. Calculate Taxes: Calculate the fuel use tax owed or refund due for each jurisdiction based on the tax rates and your fuel consumption. 5. Complete the IFTA-105 Form: Fill out the IFTA-105 form with the calculated taxes, ensuring to include all required information. The PDF Form IFTA-105, particularly the Final Fuel Use Tax Rate and Rate Code Table 1, is a critical tool for motor carriers operating under the IFTA. By understanding how to use this form and table, carriers can accurately calculate their fuel use taxes, ensuring compliance with IFTA regulations and avoiding potential penalties. Regular updates to the tax rates and codes in Table 1 underscore the importance of staying informed about changes in fuel tax laws across different jurisdictions. For carriers, navigating the complexities of fuel use taxation becomes more manageable with a comprehensive guide to the IFTA-105 form and its components.By following the guidelines and understanding the intricacies of the IFTA-105 form and the Final Fuel Use Tax Rate and Rate Code Table 1, motor carriers can streamline their tax reporting process, reduce errors, and focus on their core operations. The accurate completion of the IFTA-105 form is not just a regulatory requirement but also a strategic business practice that can impact a carrier's bottom line. As the transportation industry continues to evolve, the importance of precise fuel tax management will only continue to grow, making the IFTA-105 form and Table 1 indispensable resources for carriers aiming to operate efficiently and compliantly.