Table of Contents

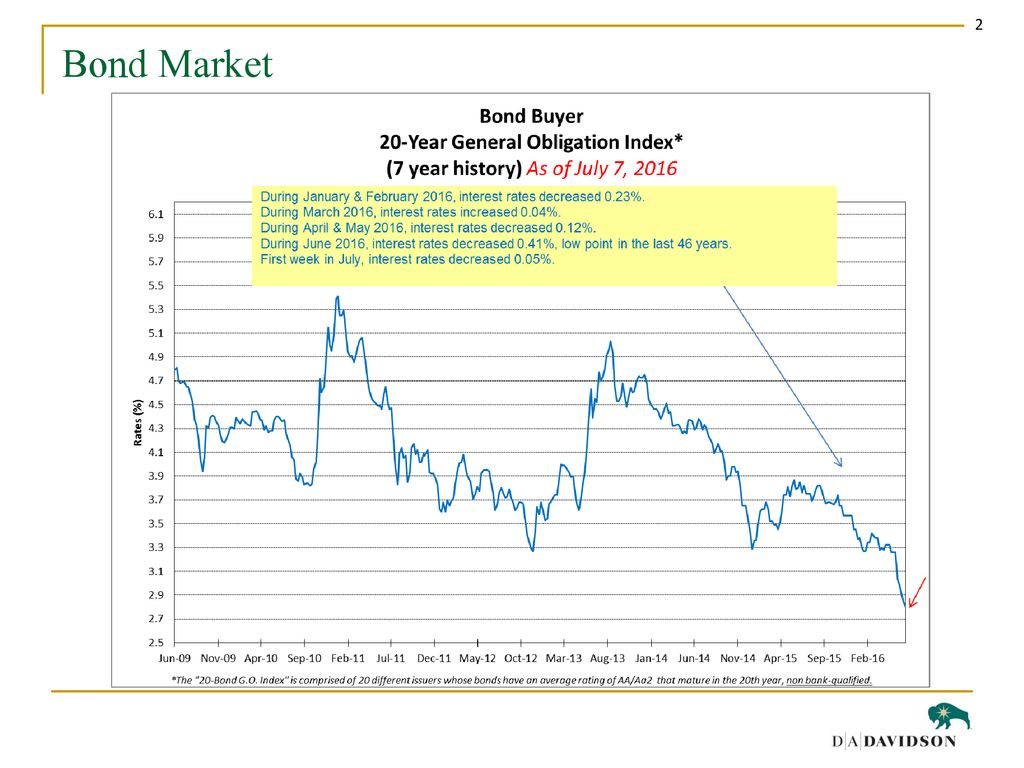

- Refunding bond discussion - ppt download

- How is it to have Indian Bond Market in Global Indices?

- What Investors Should Know About Bonds | Investing | US News

- What Investors Should Know About Bonds | Investing | US News

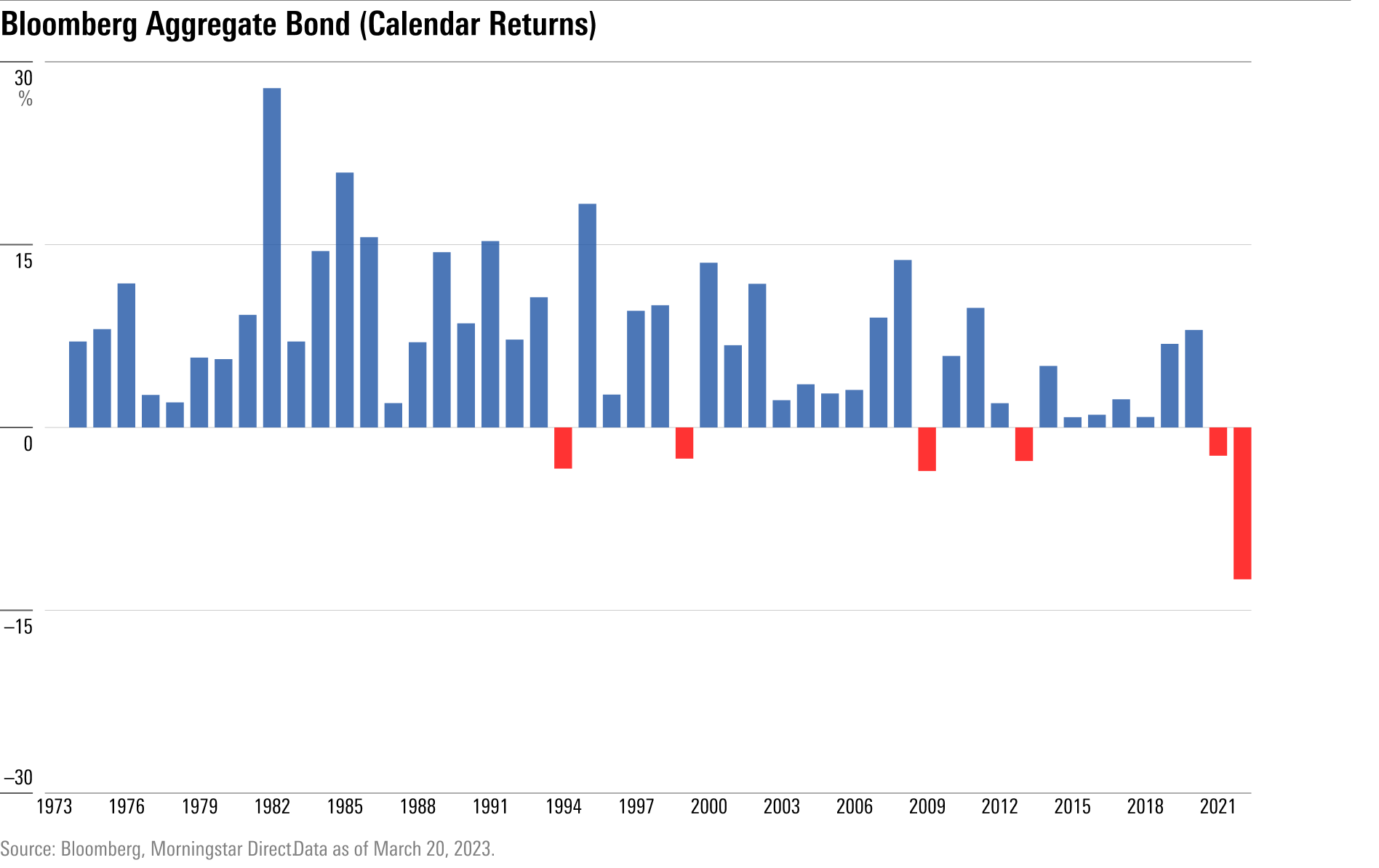

- The Return of the Bond Market | Morningstar

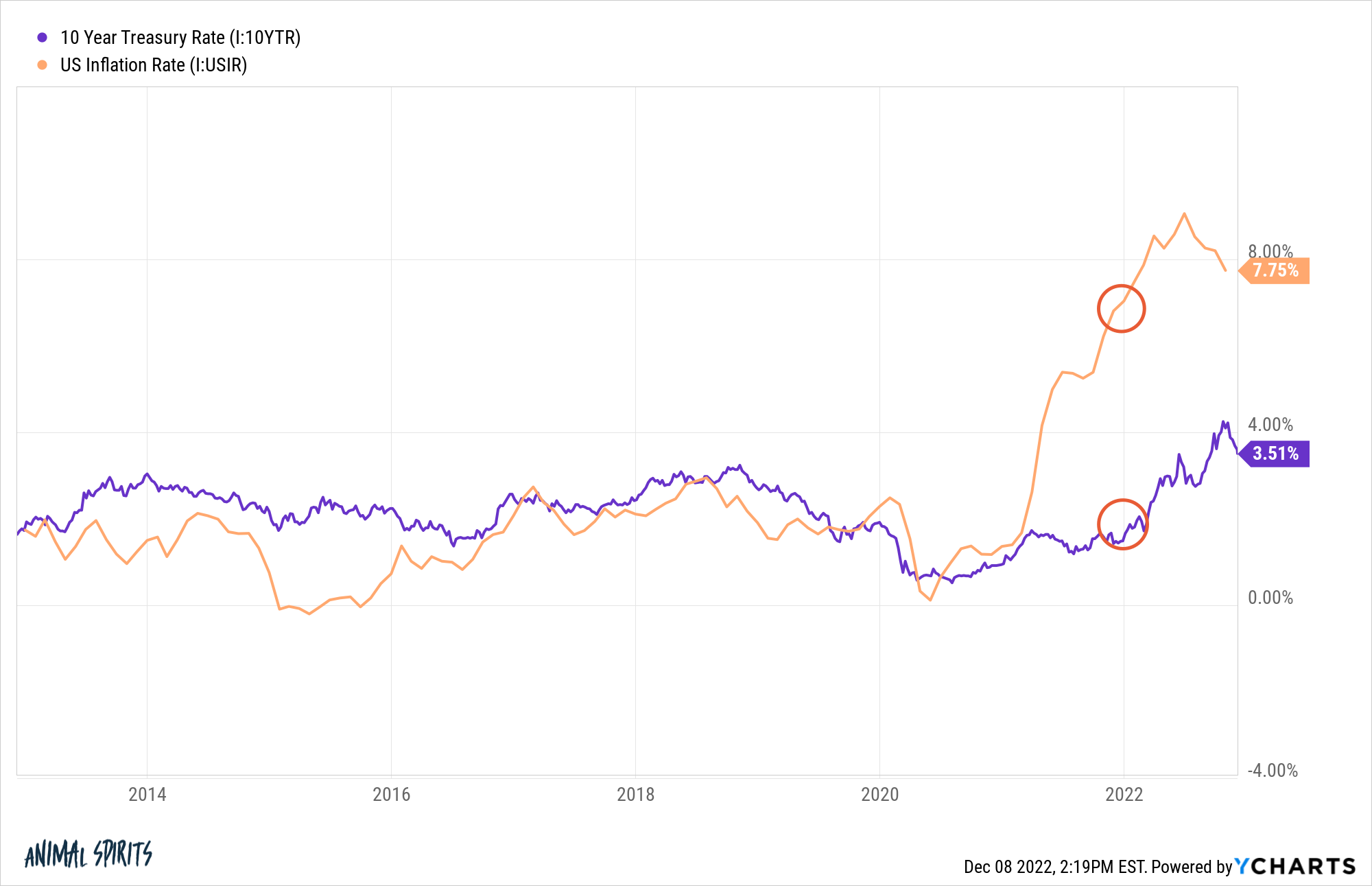

- What Is the Bond Market Saying About the Economy? - A Wealth of Common ...

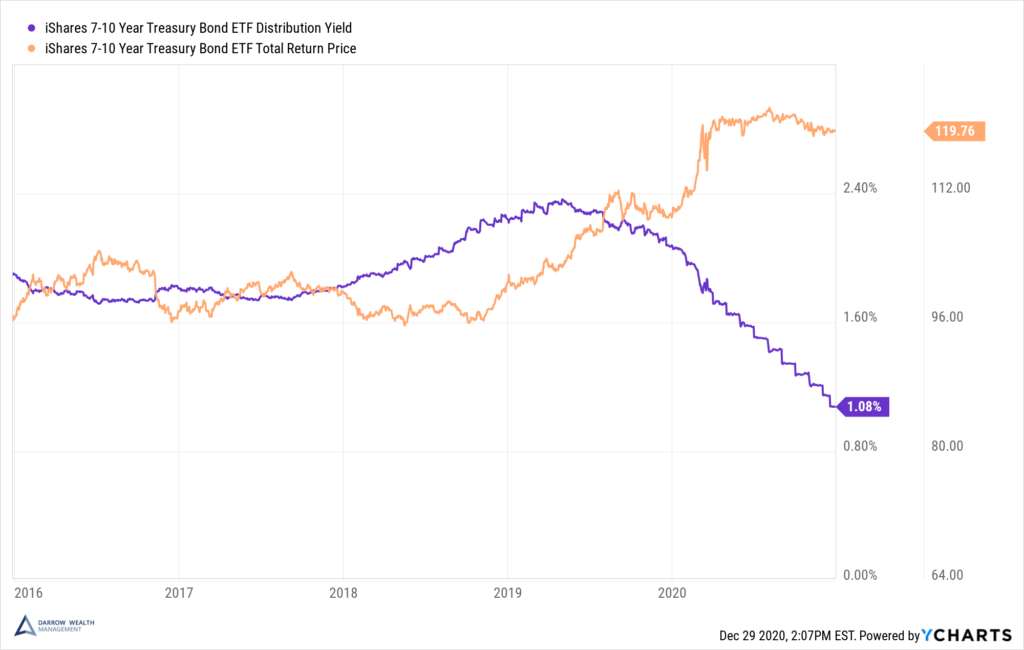

- How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond ...

- How the Bond Market Works - YouTube

- How is it to have Indian Bond Market in Global Indices?

- Bonds - CathalAghamjot

What are Bonds?

The Bond Market

Bond Prices and Rates

Bond prices and rates are closely linked. When you buy a bond, you pay a price, which is typically expressed as a percentage of the bond's face value. The price you pay will determine the yield, or return, you receive on your investment. The yield is calculated by dividing the annual interest payment by the bond's price. For example, if you buy a bond with a face value of $1,000 and an annual interest payment of $50, and you pay $900 for the bond, the yield would be 5.56% ($50 ÷ $900).

Types of Bond Rates

There are several types of bond rates, including: Coupon Rate: The interest rate paid periodically to bondholders. Yield to Maturity: The total return on investment, including interest payments and capital gains or losses. Current Yield: The annual interest payment divided by the bond's current price.